The receivables turnover ratio is an activity ratio, measuring how efficiently a firm uses its assets.

In addition, the ratio can be skewed by particularly fast or slow-paying customers, giving a less than accurate picture of your overall collections process.Receivable Turnover Ratio or Debtor's Turnover Ratio is an accounting measure used to measure how effective a company is in extending credit as well as collecting debts. First off, the ratio is an effective way to spot trends, but it can’t help you to identify bad customer accounts that need to be reviewed. While the AR turnover ratio can be extremely helpful, it’s not without drawbacks. Are there any limitations to the accounts receivable turnover ratio? That’s not bad, but it may indicate that Company A should attempt to optimise their accounts receivable to speed up the collections process. This means that Company A is collecting their accounts receivable three times per year. To determine the AR turnover ratio, you simply divide £150,000 by £50,000, resulting in a score of 3. Company A has £150,000 in net credit sales for the year, along with an average accounts receivable of £50,000. To give you a little more clarity, let’s look at an example of how you could use the receivables turnover ratio in the real world. Assuming you know your net credit sales and average accounts receivable, all you need to do is plug them into the accounts receivable turnover ratio calculator, and you’re good to go. You can also use an accounts receivable turnover ratio calculator – such as this one – to work out your AR turnover ratio. This will give you a figure for average accounts receivable.įind your accounts receivable turnover – Finally, you just need to divide your net credit sales by your average accounts receivable, and you should end up with your receivables turnover ratio. Work out your average accounts receivable – Next up, you need to take the total number of accounts receivable entries at the beginning of the year, add it to the value of your accounts receivable at the end of the year, and then divide by two. If you’re struggling, you should be able to find your net credit sales on your balance sheet. Once you know the formula, you just need to follow these steps to calculate your AR turnover ratio:ĭetermine your net credit sales – Your net credit sales are all the sales that you made throughout the year that were made on credit.

#Account receivable turnover in days how to

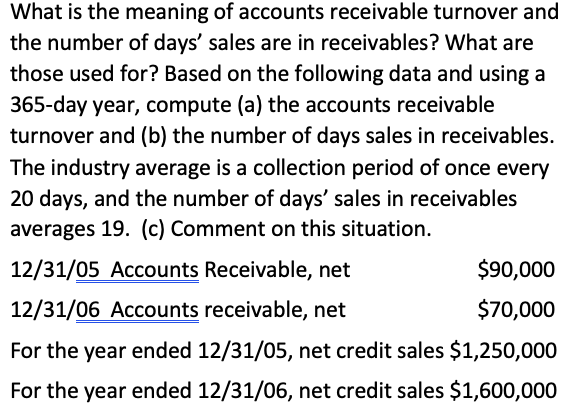

If you’re trying to work out how to find accounts receivable turnover, there’s a simple receivables turnover ratio formula you can use:Īccounts Receivable Turnover = Net Credit Sales / Average Accounts Receivable Learn more about Accounts Recievable How to find accounts receivable turnover Take a look at our article on accounts receivable process improvement ideas for inspiration.

If your company does have a low AR turnover ratio, optimising accounts receivable could be a good move. By contrast, a low receivables turnover ratio could be caused by the fact that your company has bad credit policies, a poor collection process, or deals too often with customers that aren’t creditworthy. That’s not necessarily a bad thing, but it’s worth remembering that it could drive potential customers into the arms of competing companies that are willing to offer credit. However, a high AR turnover ratio could also indicate that your company is very conservative when it comes to offering credit. Typically measured on an annual basis, a high receivables turnover ratio may mean that your company’s accounts receivable process is effective, and that you have large numbers of high-quality clients who are happy to pay their debt quickly. The accounts receivable turnover ratio, which is also known as the debtor’s turnover ratio, is a simple calculation that is used to measure how effective your company is at collecting accounts receivable (money owed by clients). Find out more about the AR turnover ratio, right here. But to gain insight into the efficacy of your accounts receivable processes, you’ll need to know your accounts receivable turnover ratio. Optimising your accounts receivable process is one of the best ways to deal with late payments. Put simply, chasing late payers has become the norm in many industries across the UK. In the UK, 2 out of 5 small-to-medium businesses (SMBs) experience serious cash flow problems as a result of late payments, while recent reports estimate the cost of late payments to SMEs to be at least £51.5 billion per year.

0 kommentar(er)

0 kommentar(er)